Welcome to our monthly REITview newsletter – where we analyze the latest national trends in real estate investment trusts (REITs) and their implications for investors and the Nevada real estate market. REITs own and often operate a pool of income-producing real estate assets. Investors can purchase a liquid stake in these portfolios – think of them as mutual funds for real estate.

While REITs are not the biggest players in Nevada’s commercial real estate landscape, secondary markets like Las Vegas with above-average population and job growth are likely to attract REITs looking for value and growth opportunities.

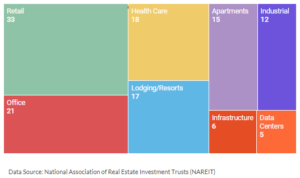

The sectors listed below, which were selected based on relevancy to Nevada, represent more than 75 percent of the 170 Financial Times Stock Exchange (FTSE) REITs currently being traded. It is useful to look at shorter-term and longer-term returns to determine trends.

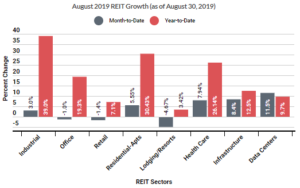

Overall, REITs saw a 2% uptick in returns in August. led by an outstanding performance by Data Center REITs, up 13.13 percent for the month (for more on Data Center REITs, see the August issue of REITview). Regional Malls took another dive in August, down 8.02 percent from the prior month, bringing their year-to-date performance to an abysmal -9.62 percent, despite having the highest dividend yield of any REIT sector (6.57 percent, annually) NAREIT tracks. Shopping Centers were also down 6.41 percent from the prior month but are still up 14.7 percent year-to-date, which still pales in comparison to Free Standing Retail’s 24.13 percent return thus far in 2019.

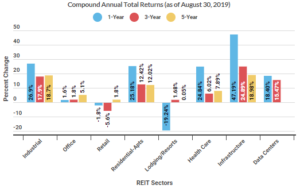

With an 8.39 percent return for August, the Infrastructure sector has now overtaken the Manufactured Home sector as the one-year leader with 47.19 percent compound annual total return and is poised to take that first place position over the three-year horizon (still held my Manufactured Homes). For more on the Manufactured Home sector, see the June issue of REITview.

Concerned about the impact of the trade war on your investments? NAREIT’s senior vice president of research and economic analysis, Calvin Schnure, addressed that risk in an August 26th article. In the article, Schnure reassures readers that “many of the main economic indicators are holding up, including continued job growth and rising retail sales,” and the U.S. is “less exposed to export markets than are most other countries.” Demand for commercial leased space continues to grow, with occupancy rates of REIT-owned properties reaching a record high of 94.1% by the end of Q2. Schnure also points out the favorable correlation (i.e., a limited one) between Equity REIT performance and global markets: “Not only are the correlations [for 2019] well below the 2013-2016 baseline, they are also a fraction of the level of correlations of the S&P 500 with overseas markets. … The economic forces that affect the demand for domestic U.S. commercial real estate differ from those affecting global corporations,” reducing the risk that trade turbulence poses to REIT performance.

In fact, NAREIT’s “Mid-Year Economic Outlook,” published in August, contends that “REITs are “poised to continue” their solid performance for the next six months. The publication summary acknowledges the uncertainty created by trade friction (discussed above), but contends that “the odds of these developments causing a recession are moderate.” The macroeconomic slowdown, NAREIT says, is a return to the growth trend we saw just prior to the 2017 tax cuts, reflecting the short-term boost that many economists predicted the cuts would have. For more on the risk of recession, see the July issue of REITview.

The second quarter saw solid demand growth for apartments and office space, which–for apartments–is typical for the spring quarter; however, even after adjusting for this seasonal pattern, “net absorption in the second quarter was the second strongest on record.” The Residential Apartment REIT sector is up 25.18 percent over the past year and 30.43 percent year-to-date. As for office space, demand “rebounded following a weak performance in the first quarter,” seeing a “23.7 million square feet jump in leased space [that] was the largest growth in demand in three years.” And unlike previous real estate rallies that were killed by overbuilding, low vacancy rates across all major property types and a balance between supply and demand indicate that overbuilding is “not a major risk for today’s [real estate] markets.”

For more on economic outlooks for REIT sectors, stay tuned for the October issue of REITview.

For live charts, please visit https://infogram.com/september-reitview-1hkv2n89yj7p2x3 .