Welcome to our monthly REITView newsletter – where we analyze the latest national trends in real estate investment trusts (REITs) and their implications for investors and the Nevada real estate market. REITs own, and often operate, a pool of income-producing real estate assets. Investors can then purchase a liquid stake in these portfolios – think of them as mutual funds for real estate.

While REITs are not the biggest players in Nevada’s commercial real estate landscape, secondary markets like Las Vegas with above-average population and job growth are likely to attract REITs looking for value and growth opportunities.

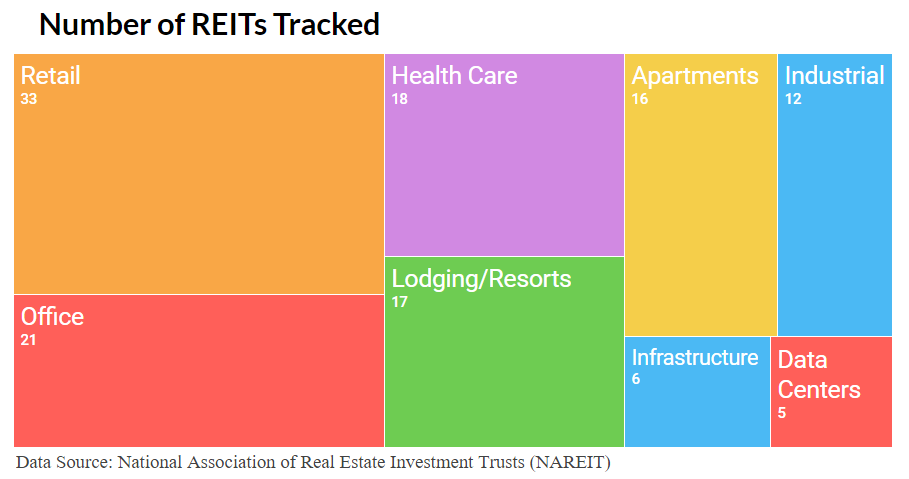

The sectors listed below, which were selected based on relevancy to Nevada, represent more than 75% of the 170 Financial Times Stock Exchange (FTSE) REITs currently being traded. It is useful to look at shorter-term and longer-term returns to determine trends.

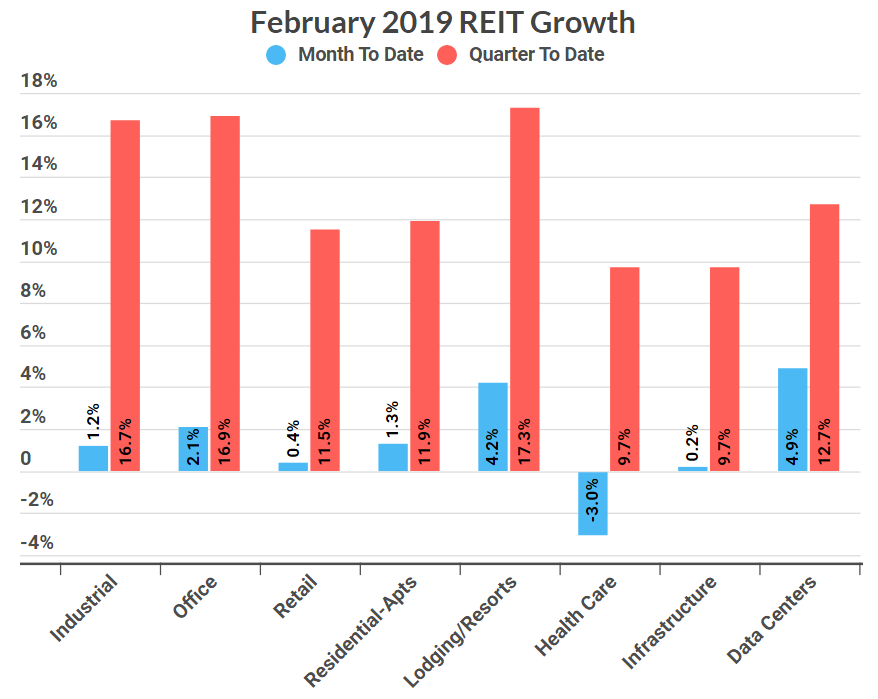

February saw growth for most REITs, though nowhere near the surge that happened in January. Data Centers saw the strongest growth in February at 4.9 percent; this uncommon occurrence is explained more by a slowing of growth in other sectors rather than an explosion in Data REITs. Next up in growth was Lodging/Resorts at 4.2 percent, climbing into the lead for growth in the quarter. Most other REITs saw slim growth after double-digit January bursts, with the surprising exception of Health Care. The sector that saw the strongest growth in 2018 is the first to backslide in 2019, falling a full 3 percent in February

Though it may have been a slow month in general, a roughly 10 percent drop by one health care REIT alone (out of 18 tracked) could shed some light on the subject. Changes in government reimbursement programs reportedly were a factor in the drop for Omega Healthcare Investors, which could hold true for other REITs across the sector as well.

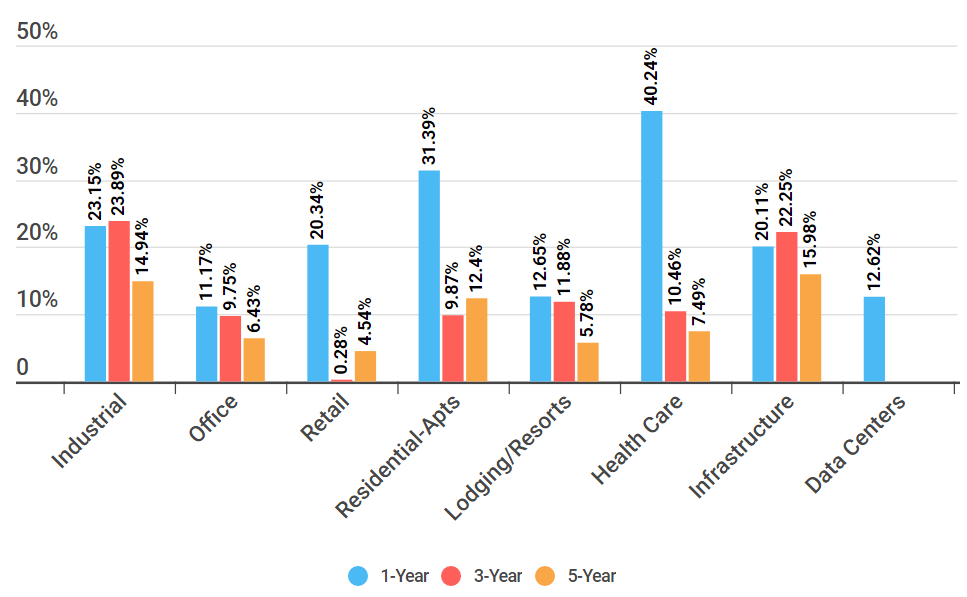

Looking longer-term however, we see that Health Care is still by far the strongest sector in 1-year growth at a whopping 40.2 percent. In fact, over the one year period none of the sectors tracked saw a loss; the weakest growth was in the still-fledgling Data Center sector at 12.6 percent.

Industrial and Infrastructure REITs showed steady growth over the three year period (23.9 percent and 22.2 percent respectively), and were the only REITs to show greater growth in three years than in one.

The same pattern was true for the five-year period, with Infrastructure (16 percent) and Industrial (15 percent) leading leading the way, and Retail again in last place at 4.5 percent. Retail saw the slimmest growth at a low 0.3 percent (not a typo); hopefully the recent gains in the sector will hold steady over the long term.

Analysts are optimistic for REITs this year, after a turbulent 2018. The main factors they’re watching? Disruptions to trade, a possible deal with China, GDP growth, and job creation- all have proven anything but certain under the Trump Administration. The future of retail is also an important factor to consider, as the industry faces the demise of the department store and plots a path to relevance in the Amazon Age.