Welcome to our monthly REITView newsletter – where we analyze the latest national trends in real estate investment trusts (REITs) and their implications for investors and the Nevada real estate market. REITs own and often operate a pool of income-producing real estate assets. Investors can purchase a liquid stake in these portfolios – think of them as mutual funds for real estate.

While REITs are not the biggest players in Nevada’s commercial real estate landscape, secondary markets like Las Vegas with above-average population and job growth are likely to attract REITs looking for value and growth opportunities.

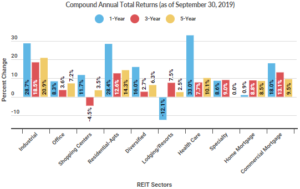

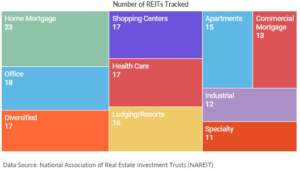

The sectors listed below were selected because they include at least 10 REITs each. They represent more than 97 percent of the 163 Financial Times Stock Exchange (FTSE) REITs currently being traded. It is important to examine both short-term and long-term returns to determine trends.

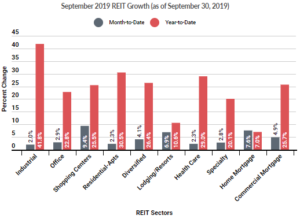

In September, Equity REITs mostly continued their gains from August, slipping by only half a percentage point overall. Health Care, Apartments, and the Industrial sectors slipped for the month, reversing direction by 5.66, 2.63, and 1.01 percentage points (respectively) from their August returns. Lodging/Resorts, on the other hand, posted gains (6.91 percent) that exceeded the prior month by over 11.5 percentage points. Diversified REITs also had a great month, improving by 4.44 percentage points. Most impressively, Shopping Centers posted a 9.44 percent return for September, a 12.84 basis point improvement over August.

Continuing our review of the outlook for REIT sectors from the September edition of REITview, we turn to a September 24th article in REIT Magazine where five fund managers and strategists weighed-in on the state of global real estate markets.

Ted Bigman, Head of Global Listed Real Estate Assets Investing at Morgan Stanley, expects a reversion to the mean, since U.S. real estate returns have outpaced global markets year-to-date. Given that “[t]he U.S. is trading, on average, at or above its typical average price to NAV [Net Asset Value], whereas other regions are trading below their traditional price to NAV averages,” we can expect global markets to close this gap over the short term. Trade tensions “have impacted sentiment more than they have impacted real operating performance”; Retail and Lodging/Resorts REITs, specifically, are suffering from the perceived threat to their returns despite strong NAVs and operations. “Some [REIT] sectors are trading at 30% and 40% premiums to NAVs,” while these “and other sectors are trading at 25% and 35% discounts to NAVs.”

Sherry Rexroad (Global REITs at Blackrock) and Nora Creedon (Goldman Sachs Asset Management), on the other hand, expect U.S. real estate to be impacted less by trade tensions than Europe and Asia, meaning comparatively moderate growth internationally. The fundamentals, combined with positive investor sentiment, bodes well for U.S. real estate returns, Rexroad says. Bernhard Krieg of Brookfield’s Public Securities Group agrees: “Generally speaking, we believe U.S. real estate is in a ‘sweet spot,’ with low rates, low inflation, and low-to-moderate growth.” Supply and demand dynamics are creating positive rental growth rates, balance sheets are healthy, and leverage is at near-record lows. Unlike other developed markets, “U.S. REITs have improved their balance sheets tremendously over the last decade,” Creedon adds. For more on the importance of strong balance sheets, see the August edition of REITview.

Even though he foresees a slower economic future in 2020, perhaps even a “mild recession,” Scott Crowe of CenterSquar Investment Management remains bullish: “we’re not suffering from the three evils that normally cause a big problem at the end of a cycle—over-leverage, over-supply or over-valuation. That means that the real estate market is in a pretty good position to weather any economic slowdown.” Since they are “domestically tilted,” Creedon says, “REITs are more isolated from [trade tensions] than many other sectors in the equity market.” Even if the economy does slow down, Crowe expects the Industrial REIT sector to continue its growth due to the efficiency and low cost of industrial warehouse distribution needed to support e-commerce. If you want to invest in international real estate markets, Rexroad recommends Japan, which has historically been viewed “as a safe haven and an income generator.”

For live charts, please visit https://infogram.com/october-reitview-1h7g6kykomej4oy.