Welcome to our monthly REITView newsletter – where we analyze the latest national trends in real estate investment trusts (REITs) and their implications for investors and the Nevada real estate market. REITs own and often operate a pool of income-producing real estate assets. Investors can purchase a liquid stake in these portfolios – think of them as mutual funds for real estate.

While REITs are not the biggest players in Nevada’s commercial real estate landscape, secondary markets like Las Vegas with above-average population and job growth are likely to attract REITs looking for value and growth opportunities.

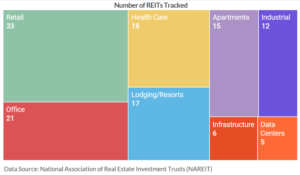

The sectors listed below, which were selected based on relevancy to Nevada, represent more than 75 percent of the 170 Financial Times Stock Exchange (FTSE) REITs currently being traded. It is useful to look at shorter-term and longer-term returns to determine trends.

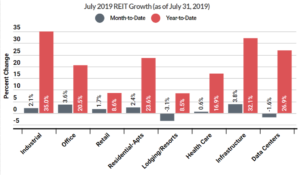

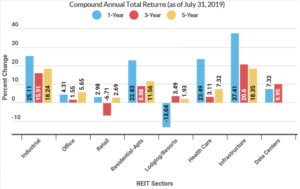

July returns for equity REITs were essentially flat versus their June performance., but our June all-stars, the Industrial and Lodging/Resorts sectors, took a dive in July, down -5.38 percent and -4.86 percent, respectively, versus the prior month , though the Industrials still had a positive month at 2.08 percent return. Regional Malls improved their monthly return by 3.07 percent but are by far the worst-performing subsector year-to-date at -2.88 percent return. That said, the Retail sector has thus far outperformed the Lodging/Resorts sector this year, buoyed by the performance of shopping centers and free standing retail. Infrastructure improved its one-year return to 37.41 percent with a 3.78 percent return for July, far better than it performed in June. Over the 10-year horizon, Self-Storage REITs have now returned 19.52 percent, second only to the Manufactured Home sector; two Manufactured Home REITs hit one-year highs this week (for more, see the June issue of REITview).

The 25 basis point cut the Federal Reserve made on July 31 to the federal funds interest rate could give the Industrial REITs a boost through the third quarter. “[C]ommercial real estate investors will likely take the [Fed’s] decision as a signal to continue buying property [in the short term], even at lofty valuation levels,” says Ryan Severino , chief economist with real estate services firm JLL. “This could extend the trend real estate markets worldwide have seen during the last decade, with investors piling into the (industrial) asset class amid a hunt for higher yields and stable returns.” On the other hand, Severino did not see the chance of negative economic growth as high even without a rate cut. Despite the trade war, the Industrial sector has been strong (its REITS are up almost 35 percent year-to-date)–“vacancy is low, rents are still growing, and the development pipeline is robust.” Over the long term the rate cut could make investors overly optimistic, “widening the rift between market expectations and the underlying economic reality, which could form the seeds of an asset bubble.”

Turning to the 5-year horizon, REIT Magazine asked three experts about mid-range investment opportunities for its July/August issue. If the Fed was right to cut rates, and there is economic turbulence ahead (for more on the likelihood of this, see the July issue of REITview), Cedrik Lachance of Green Street Advisors recommends looking at balance sheets. The best bets, he says, are REITs that learned from the Great Recession and have lower Debt-to-Equity ratios and somewhat higher Current ratios (compared to their industry peers). “At the sector level, data center REITs are in a unique position to flourish given the continued technological evolution” that is creating demand for data storage and connection. Lachance also likes single-family-home REITs, given the number of millennials who will be forming family households by 2025.

Bob O’Brien of Deloitte also likes data center REITs. “Companies are moving their information technology applications to the cloud—in other words, moving their data from servers located in their own facilities to large cloud service providers, who are the largest tenants of data centers.”

Despite the current state of the Lodging/Resorts sector’s returns, Diane Wade of CBRE Clarion Securities likes gaming REITs because, she says, “we are late in the overall economic cycle, late in the property cycle for many of the REIT sectors, and in an uncertain political climate.” Not only does the gaming industry tend to perform relatively well in economic downturns, “[t]he leases are longer term with no capital expenditures,” there’s “continued opportunity for cap rate compression to drive … net asset values higher,” and–to Lachance’s point–the sector’s REITs provide above average dividend yields that are well-covered by their current assets.

In summary, data center and gaming REITs with strong balance sheets are worth a closer look to hedge the risk of a future downturn.

For live charts, please visit https://infogram.com/august-reitview-1hdw2jq9zjgx4l0.