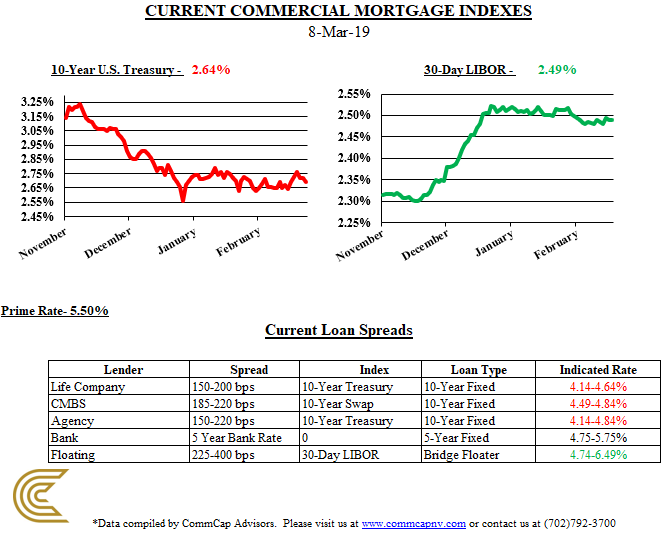

Our friends at CommCap Advisors have the latest word on commercial mortgages and the 30-day LIBOR:

The 30-day LIBOR remained unchanged for the month of February while 10-year U.S. Treasury rose 10 basis points during the same period.

Life Insurance Companies had a strong 2018 and have significant allocations for 2019. Borrowers continue to favor life company debt for their lower leverage, longer-term loans. Life companies remain active and are aggressively seeking more business. In a search for greater yield, during this extended stretch of low interest rates, life companies are starting to enter the bridge lending space.

The CMBS market saw the total volume of loans fall from $85 billion in 2017 to $77 billion in 2018. This year is expected to continue the decline and end at approximately $70 billion. Originally used for higher leverage loan requests, the more conservative interest only options are now a key selling point, thus allowing them to compete with life insurance companies. As they shift their focus on lower leverage loans, many CMBS lenders spoke about their increasing involvement in loan servicing. This comes as an effort to improve an area known for being the least favorite feature.

The growing number of new Bridge programs from bridge lenders and permanent financing lenders was the common theme this year. Now “bridge to bridge” lending is growing as renovation or construction projects with maturing loans often need more time and/or funds to stabilize. In this environment, everything costs more and takes longer, especially with a tight labor market. The increasing popularity of these programs has led many to enter the market.

Properties continue to trade at historically low cap rates. Commercial real estate investors need to be increasingly selective and target properties with more value-add opportunity. At the same time, debt financing for these types of transactions is more available than ever.